EDD Automation

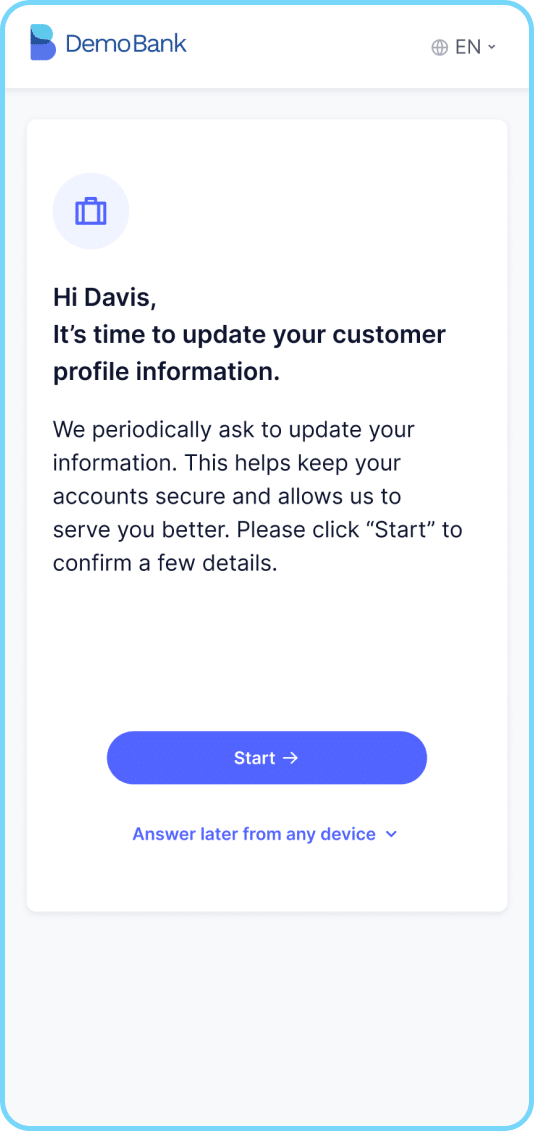

Intelligent Customer Outreach for Enhanced Due Diligence

Keeping high-risk customer data up to date for Enhanced Due Diligence (EDD) is an ongoing challenge, requiring significant effort and resources from banks. Refine’s Intelligent Customer Outreach automates this critical task, streamlining data collection and ensuring compliance with speed and accuracy.

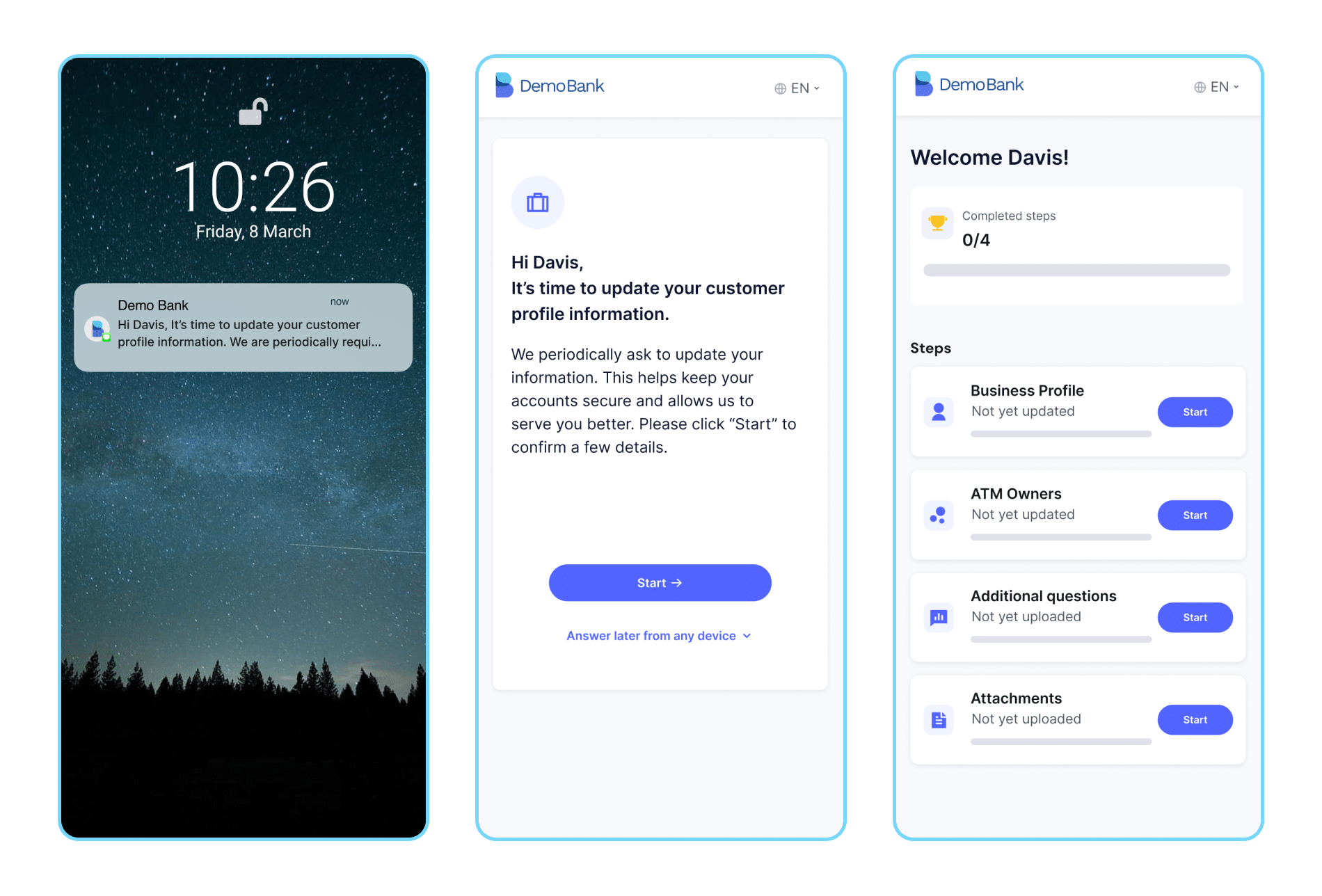

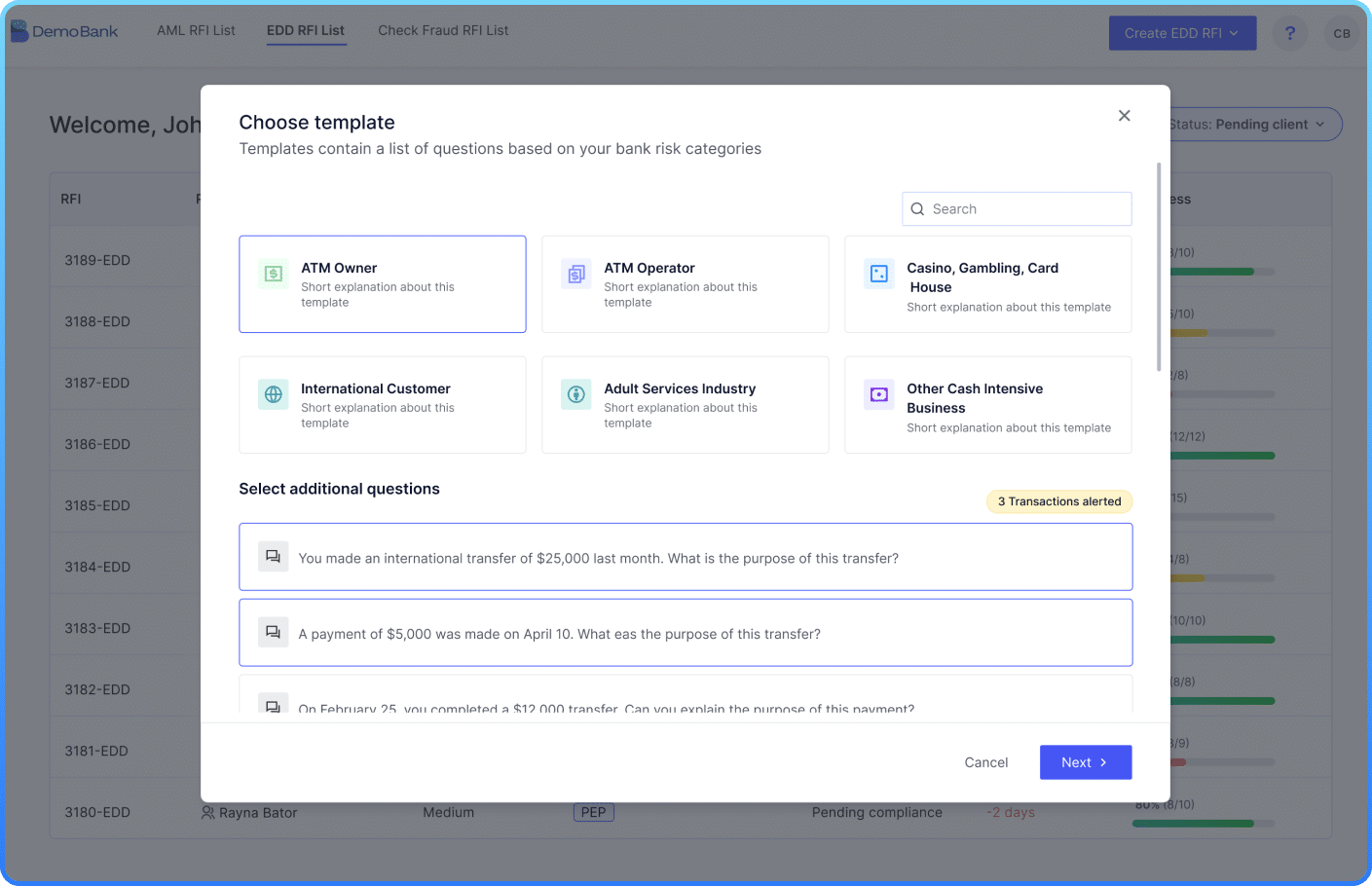

Individual Refresh

Customizable per customer or data point

Missing data points

Alert-based requests

- Ad hoc workflows

Bulk Refresh

Send thousands of RFIs at once

Clear backlogs

Data cleanup/ integrity

Post acquisition updates

Fully automate EDD workflows

Positive customer experience