Exploring a Resurging Risk in the U.S Banking Industry

Late one restless night in 2023, I found myself in front of the television, mindlessly flipping through channels until I stumbled upon a classic: Steven Spielberg’s Catch Me If You Can. Captivated by Frank Abagnale’s exploits in check fraud, I couldn’t help but wonder: why aren’t modern-day fraudsters still employing such elaborate schemes? As the ending credits rolled, my curiosity arose, pushing me to dive deeper into the world of check fraud in the U.S banking industry.

However, contrary to my initial feeling, and to my surprise, check fraud is skyrocketing. In recent years, the U.S banking system has experienced a concerning surge in this type of fraud, due to the rise of new MOs (Modus Operandi) used to defraud individuals and businesses. Assuming the current trend continues in 2024, it becomes even more important to understand the dynamics of this type of fraud and try to anticipate the deceptive tactics employed by fraudsters.

Check fraud includes a variety of techniques involving the unauthorized use of checks. In 2021, financial institutions in the U.S reported over 350,000 potential cases of check fraud to FinCEN, marking a 23% increase from 2020. This alarming trend persisted in 2022, with the reported number of potential check fraud cases reaching 680,000—nearly doubling the figures from 2021 (Source: FinCEN).

Understanding the wide array of check fraud techniques is crucial for fighting this type of fraud. The following section explores four prevalent MOs employed by fraudsters to exploit vulnerabilities within the check payment system:

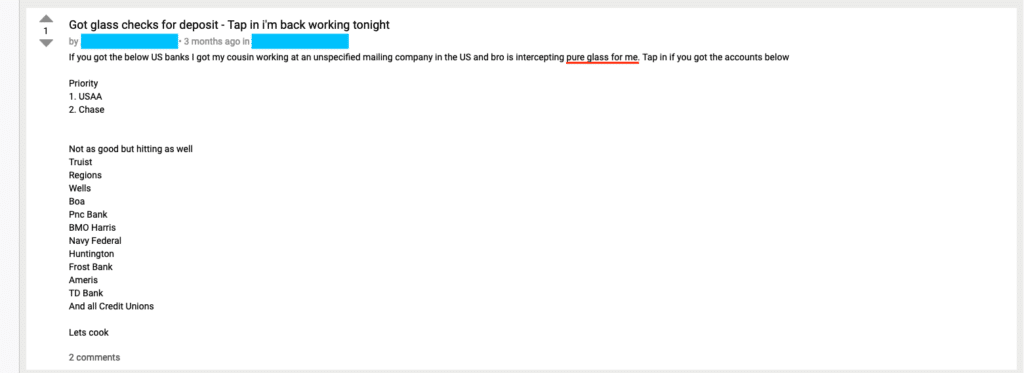

“Glass Check Fraud”

A relatively new fraud method that involves the physical theft of mailed paper checks inside the U.S Postal System (USPS). According to fraudsters, the method is commonly called ‘glass’ on the dark web because “the checks always clear.” It often requires insiders, for instance, cooperative postal workers who provide copies of mailbox keys, or steal mail that looks like it would have a check inside. They then turn over the checks to the fraudsters for resale.

Here‘s how it works: The fraudster sells the stolen check to a buyer for a fixed price or a percentage of its value, usually using cryptocurrency. Later, they digitally change the checks using scanning/printing software to falsify the recipient, amount or account information, and deposit them into bank accounts controlled by individuals known as ‘mules’. These accounts then pay out the money to the buyer through various methods like cash, Western Union wires, or digital wallets.

The buyer takes the risk that the altered check won’t clear. But because the person who wrote the check doesn’t know it’s been stolen, it probably hasn’t been canceled yet. It’s only when the intended recipient realizes they never got their payment that they realize they’ve been defrauded.

Visual 1: A fraud ring selling ‘glass checks’ from over a dozen U.S banks in a dark web fraud forum. Source: Daniel Shkedi/Refine Intelligence.

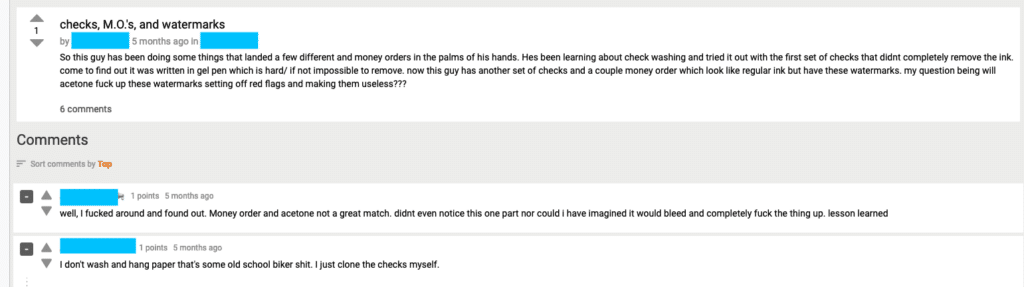

Check Washing

“Check Washing” is when information on the check is changed to falsify the recipient, amount or account information. Some fraudsters use physical tools or chemicals (e.g, acetone) to erase information. In the following example taken from a dark web forum, a fraudster is asking for advice on removing watermarks from stolen checks.

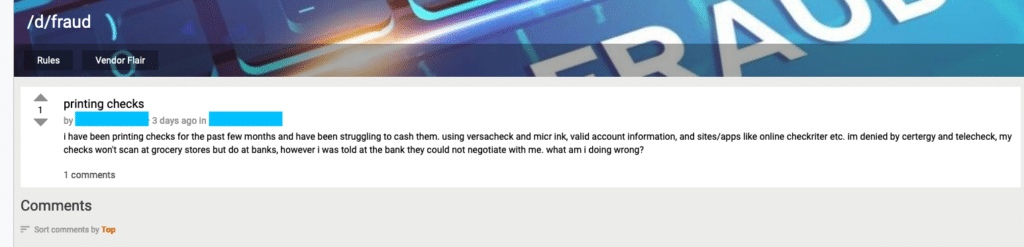

Visual 2. A fraudster seeking advice on removing watermarks and other information from stolen checks. Source: Daniel Shkedi/Refine Intelligence.

Counterfeit Checks

Counterfeiting involves the creation of fraudulent checks that appear legitimate but are 100% fake. Fraudsters try to replicate bank logos, watermarks, and security features to deceive unaware victims and financial institutions. With advancements in printing/scanning technology, counterfeiters can produce high-quality fake checks that closely resemble authentic ones, making detection challenging.

Visual 3. A check fraudster who’s encountering difficulties while cashing counterfeit checks. Source: Daniel Shkedi/Refine Intelligence.

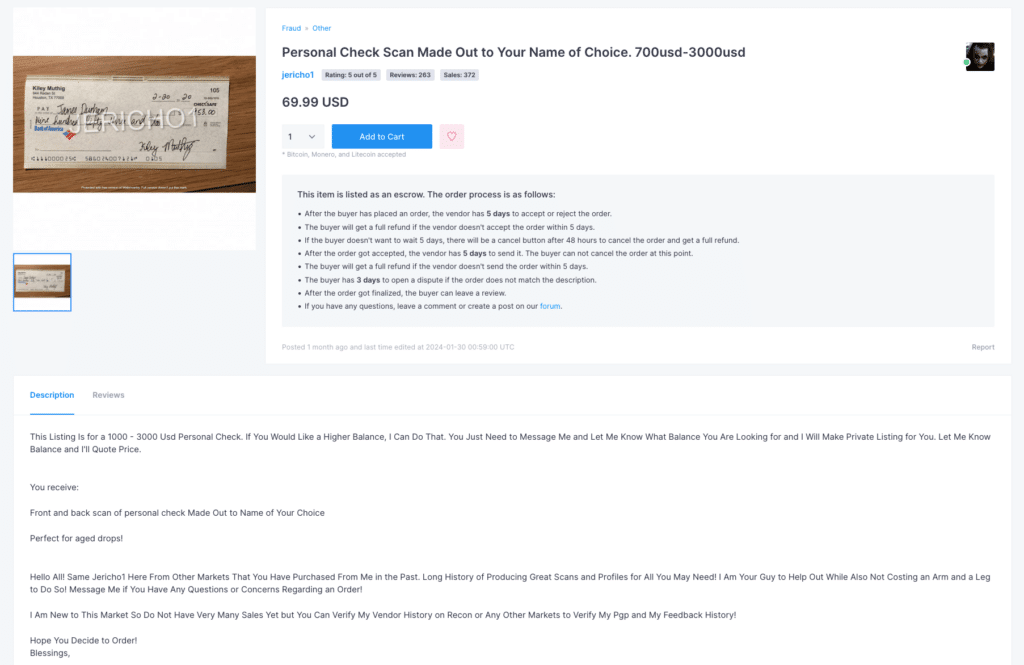

Visual 4. A fraud ring offering personal check scans made out to the buyer. The check amount is $3000-$7000 and the service costs $70. Source: Daniel Shkedi/Refine Intelligence.

Account Takeover (ATO)

Account takeover involves unauthorized access to individuals’ or businesses’ bank accounts to initiate fraudulent transactions, including check writing and e-transfers. Fraudsters use stolen credentials, phishing scams, or malware to compromise accounts, then taking over financial assets for illegal activities. Account takeover schemes often go undetected until victims discover unauthorized transactions or suspicious activity in their accounts.

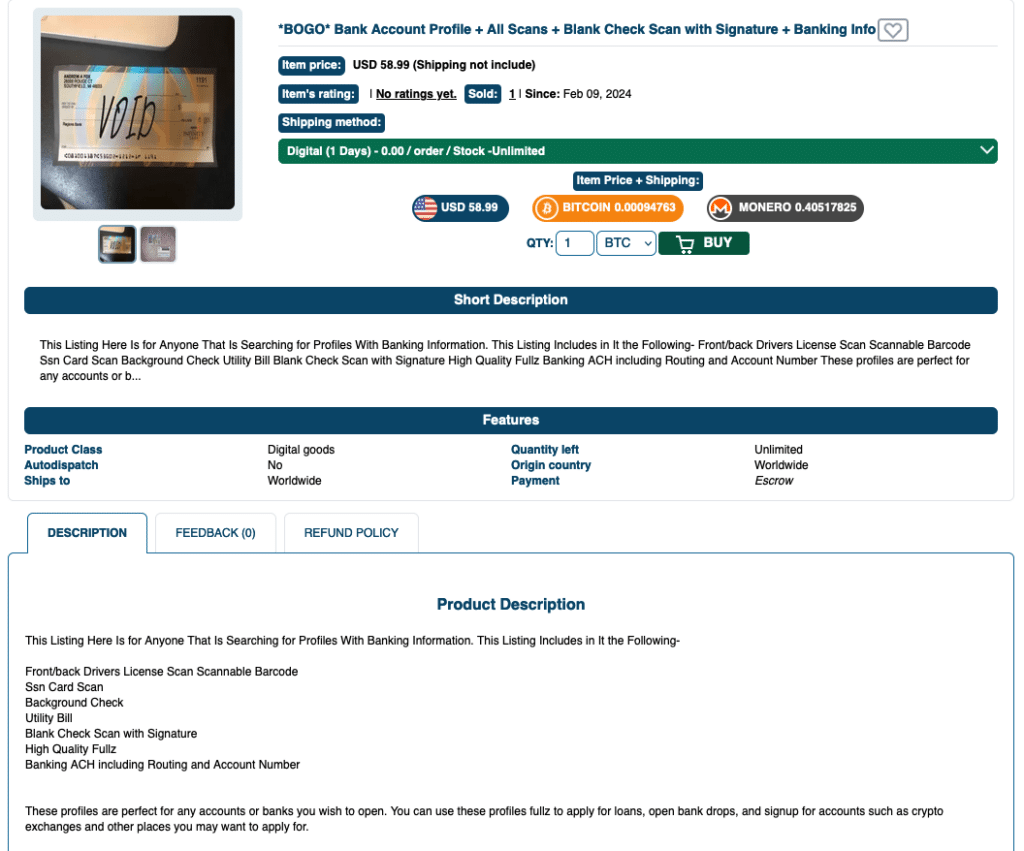

Visual 5. Bank account info + blank check scan (with signature) sold for $59 in a dark web marketplace. Source: Daniel Shkedi/Refine Intelligence.

Direct Engagement Strategies for Check Fraud Prevention

To tackle the resurging threat of check fraud, risk teams at financial institutions should adopt new technologies and best practices to foster direct communications with their customers. In most cases, check fraud exploits the time it takes for funds to clear and the lack of direct communications between bank risk teams (usually at the corporate HQ), branches and customers.

Direct engagement with customers through in-app pushes, SMS messages or omnichannel communications is extremely important in combating check fraud for several reasons: First, it dramatically reduces the time it takes to gather critical information from the customer regarding a suspicious check, allowing both sides to take prompt action in confirmed fraud cases. Second, direct engagement provides an opportunity for financial institutions to educate customers about emerging fraud trends, best practices for safeguarding their accounts, and steps to mitigate potential risks. Finally, personalized communication creates a sense of trust and transparency between financial institutions and their customers, fostering a proactive approach to fraud prevention.

In conclusion, check fraud remains a serious risk that demands proactive measures and collaborative efforts to mitigate effectively. By understanding the diverse spectrum of check fraud techniques and implementing new strategies, risk teams and organizations can improve their fraud prevention operations in an ever-evolving financial landscape. Direct engagement, education, and technological innovation are all pivotal in mitigating risks and protecting the integrity of the check payment system.

—

To learn more about how Refine Intelligence fosters direct communications between risk teams, branches, and customers to fight fraud and financial crime, read about our Direct Customer Outreach solution.