Most fincrime alerts are triggered by legitimate customer activity, but reaching out to customers on traditional channels is challenging.

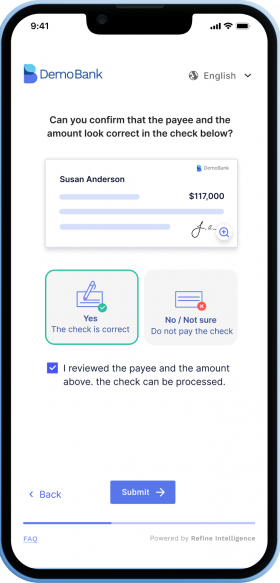

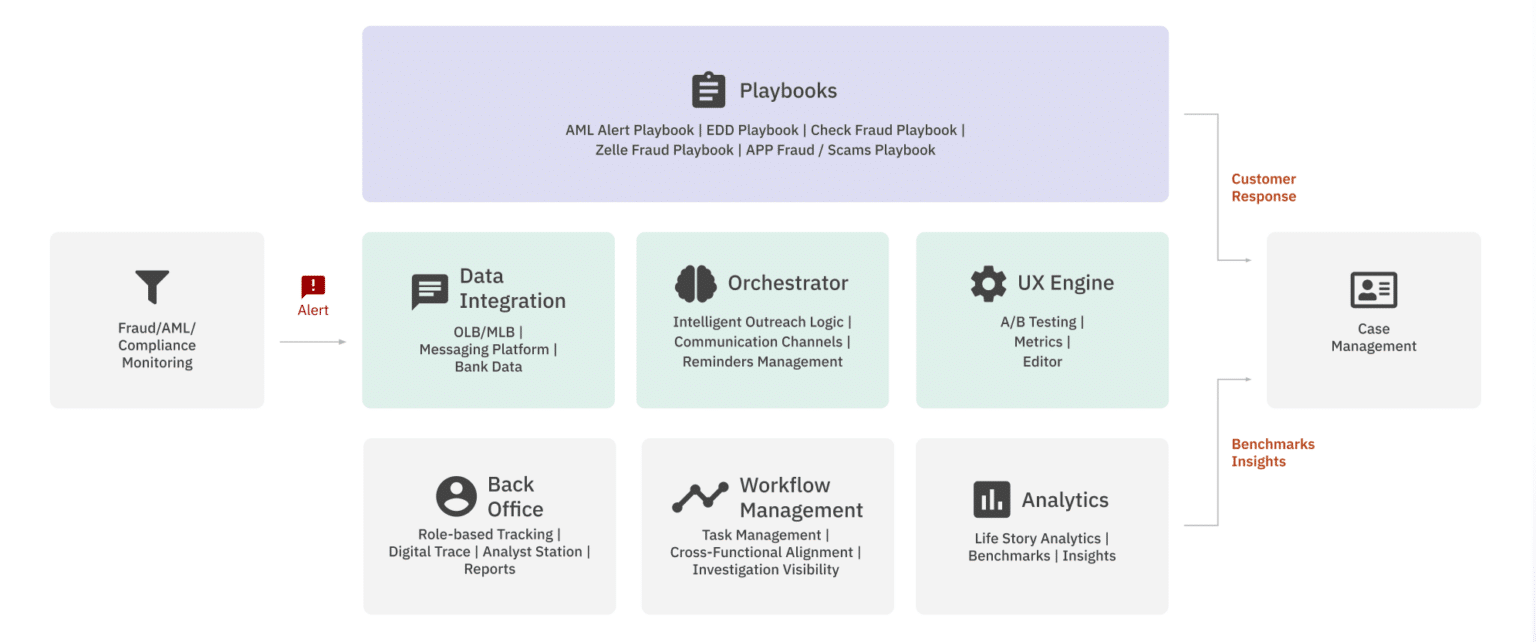

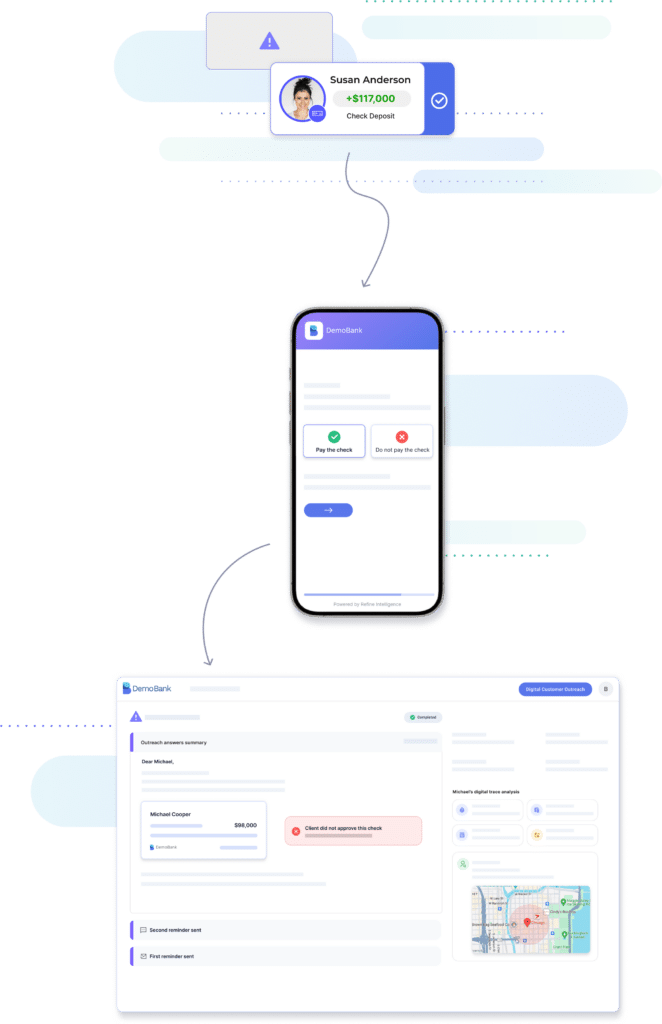

Refine’s Intelligent Customer Outreach Platform automatically engages customers through multiple communication channels, guiding them through a relevant, user-friendly digital interaction (“playbook”) and collecting structured responses that are instantly shared with the relevant bank teams.

Smart routing and intelligent outreach logic, e.g., which customers should be contacted, when messages should go out, reminder policy, and more.

Deliver messaging via preferred channels (SMS, email, app) using secure APIs, bank’s own messaging system, or the Refine platform.

Optimize UX and meet customer needs with built-in A/B testing and playbook customization.

Back office management tool for creation, management, and reporting on requests for information (RFIs).

Statistical benchmarks map common life stories and can be combined with open source intelligence to highlight likely explanations for anomalies, shortening investigation time.

Generates timely communications to relevant bank teams based on inquiry progress and customer responses.

©2024 Refine Intelligence