Check fraud has been rising alarmingly across the US for the past 3-4 years, and it’s showing no signs of slowing down. With alarm bells ringing about losses due to check fraud, we’ve gathered the check fraud statistics that you need to know to understand the situation.

Current check fraud statistics

Consumer and business check fraud losses amounted to approximately $21 billion last year, with analysis by the American Bankers Association (ABA) revealing over $1.3 billion in losses for US financial institutions. Experts predict that check fraud losses will exceed $24 billion in 2024.

When you look at the number of reported cases of suspected fraud, check fraud is once again riding high. Thomson-Reuters reports that in 2023, the total number of Suspicious Activity Reports (SARs) filed came to 3.8 million, 5% higher than 2022, with check fraud accounting for 20% of those reports. Over half the SARs are filed by the top 5 or 6 banks, which experience over 100,000 fraud attempts each year.

Data compiled by the Association for Financial Professionals (AFP) shows that 47% of organizations likewise reported fraud activity involving paper checks. FinCEN received 15,417 BSA reports of mail theft-related check fraud between February 27 2023 and August 31 2023 alone, reflecting over $688 million in transactions.

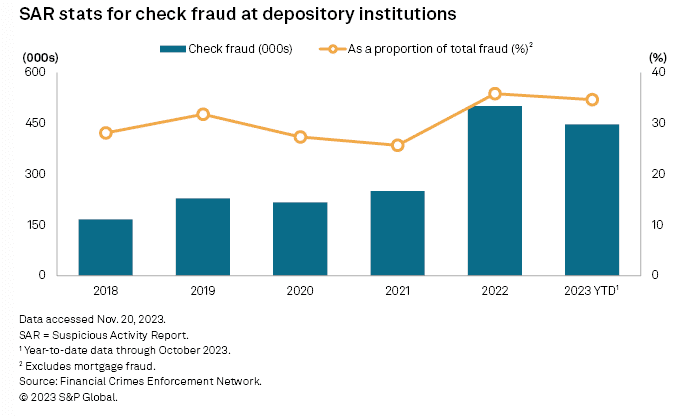

Check fraud accounts for a significant slice of all fraud that banks have to grapple with. Research by American Banker found that on average, 36% of all bank fraud is due to check fraud. SP Global reports that in 2023, check fraud accounted for more fraud than any other type apart from mortgage fraud. For example:

- ServisFirst’s non-core expenses increased by $1.4 million due to legal expenses related to credits, check fraud and credit card fraud.

- At Truist, check fraud contributed to a $33 million increase in operating losses during the third quarter.

Trends in check fraud statistics

All the trends point to an increase in check fraud, both in terms of the number of attempts and the value of funds that are being stolen. Thomson-Reuters predicts that SARs filings will increase at a rate of 4-5% in 2024.

According to FinCEN reports, 2021 saw over 350,000 check fraud-related SARs, a rise of 23% over 2020. That number almost doubled in 2022 to reach over 680,000. Overall, SP Global reports, the number of SARs for check fraud rose 201.2% between 2018 and 2022, with personal and business checks seeing a sharper increase than other other financial instruments.

Check Fraud Statistics: SAR stats

Another study used US Department of Treasury data to calculate a 90% increase in check fraud-related SARs from 2021 to 2023. According to AFP analysis, 80% of organizations experienced payments fraud in 2023, a 15-percentage point increase over 2022 and the highest rates reported since 2018. Checks are the payment method most vulnerable to fraud, says the AFP, with 65% of respondents saying they experienced check fraud.

To give an idea of the scope of the problem, these are the losses that one mid-size bank, Regions Bank, reported in a Q3 2023 earnings call:

- Q1 2023: $20M

- Q2 2023: $82M

- Q3 2023: $53M

- Q4 2023: $25M (estimated)

Research by Datos Insights showed that losses to check fraud are rising far more sharply than those due to any other type of fraud. When asked about trends in different types of payment fraud, 2 out of 5 said that rates of third-party and first-party check fraud losses had risen at least 10% in the past two years, while only 32% said the same about P2P fraud losses, the next fastest-growing type of fraud. By comparison, only 7% said the same about credit card fraud, although it’s a much bigger cause of anxiety for most people.

Interestingly, check fraud appears to be seasonal. One study found that it spikes around the tax season, taking advantage of tax refund disbursements. Meanwhile, data from Thomson-Reuters analysis indicates that SAR volumes fall in January and February and then surge in late spring and late summer, reflecting seasonal business patterns which are usually slow in January-February.

Dr. David Maimon, Professor at Georgia State University and Founder and Director of the Evidence Based Cybersecurity Research group, reported over 9000 stolen checks listed each month on 80 groups on the dark web and other encrypted messaging platforms like Telegram in 2023, a significant increase. BlueVoyant reports that dedicated check fraud IM channel groups have grown over 500% since January 2022.

Historical data about check fraud

Historical data shows that the 1970s saw rampant check fraud, with losses reaching $4 billion by 1976. This is equivalent to over $20 billion today, which isn’t far from estimates of current check fraud losses. Most experts consider that it peaked in the mid 1990s and then began to decline, partly due to check falling out of use, and partly because of new technology like Positive Pay and EWS.

Thomson-Reuters reports that until 2021, check fraud was averaging around a quarter of a million SARs per year, rising at a rate of roughly 2-3% YOY. However, since the pandemic, check fraud has surged. CNN reported a nationwide increase of 385% since the pandemic, according to the U.S. Treasury Department, and FinCEN reports that it doubled between 2021 and 2022. According to the FBI, 70% of U.S. financial institutions reported check fraud in 2021, resulting in over $18 billion in losses.

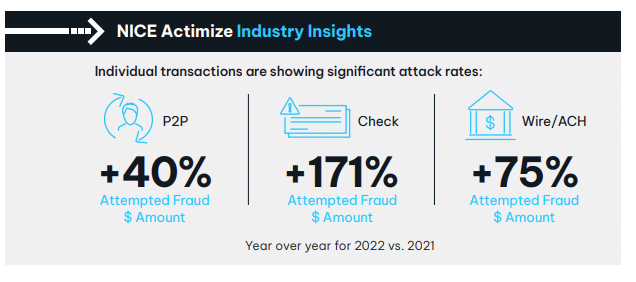

This infographic from NICE Actimize shows the disproportionate rise in attempted check fraud between 2021 and 2022:

Check fraud statistics from NICE Actimize

Demographic breakdown of check fraud

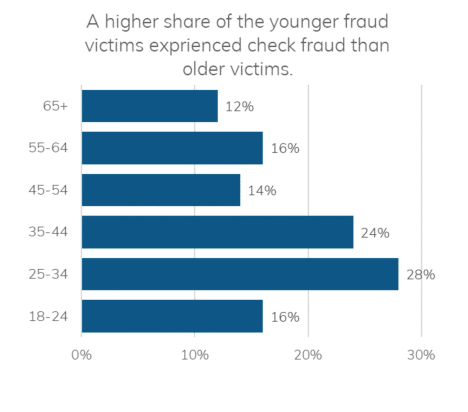

Interestingly, demographic analysis shows that far more younger people have been victims of check fraud than older people, even though older age groups say they write more checks. A study by Abrigo found that 28% of 25-34 year olds had suffered check fraud, compared with just 12% of those aged over 65 and 16% of those aged 55-64.

Check fraud statistics about younger vs. older victims

Most common types of check fraud

It’s clear that mail check fraud is a serious and rising issue. FinCEN reports that the US Postal Inspection Service (USPIS) reported 38,500 high volume mail theft incidents from mail receptacles (including blue USPS collection boxes) between October 2021 and October 2022, and over 25,000 in H1 2023. Although most mail theft was non-violent and took place from mailboxes, 305 mail carriers were robbed in the first half of 2023, compared with 412 between October 2021 and October 2022.

Once checks were stolen, FinCEN reports, the majority (44%) were altered and then deposited (often using checkwashing). 26% were used as templates to create counterfeit checks, and 20% were fraudulently signed and deposited. Thieves usually tried to avoid human contact when depositing stolen checks, preferring remote deposit capture (RDC) or ATMs.

FinCEN adds that when checks were altered, it was usually the payee line that was changed, followed by the amount, which was usually made out to be higher than intended. Thieves also forged signatures and changed issuer information. Sometimes they didn’t change any information, simply signing the back and attempting to negotiate the check, although this was the least common approach to check fraud.

Geographic distribution of check fraud cases

FinCEN reporting shows that mail-related check fraud is a nationwide problem in the US, with incidents in every US state, Washington, D.C., and Puerto Rico.

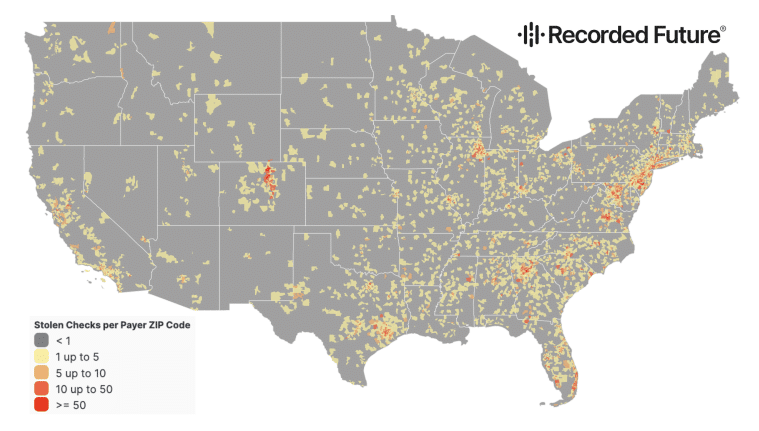

However, as can be seen on this graphic from Recorded Future, the geographic distribution of check fraud is particularly highly concentrated in the eastern seaboard, and around large metropolitan areas like New York City and Baton Rouge.

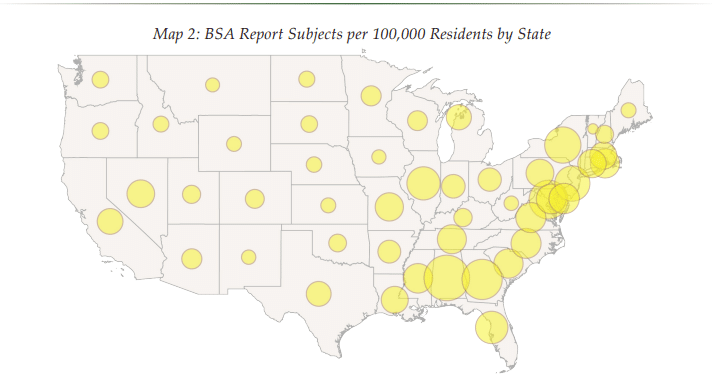

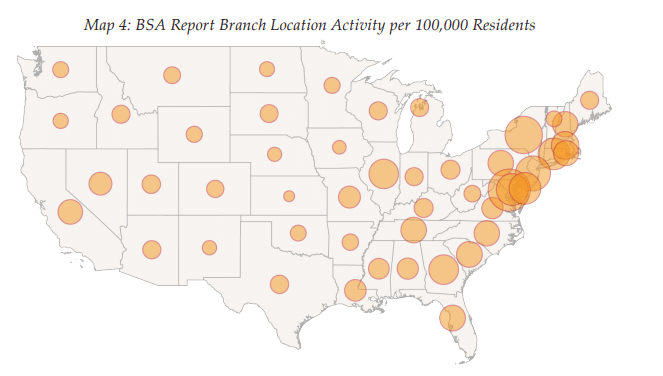

FinCEN’s infographics of BSA reports show a similarly high rate of reported check fraud incidents along the eastern seaboard and into the south-east. However, there are small but interesting differences between the rates of reported incidents per 100,000 residents, and the rates of fraudulent check cashing and deposits according to branch location.

The following map plots reports per 100,000 residents for every state. Alabama and Georgia top the list, along with New York, New Jersey, and Washington, D.C.

However, the following map shows report brand location activity per 100,000 residents. This time, Alabama and Georgia fall out of the top five, replaced by Maryland and Delaware.

The financial impact of check fraud

According to Nasdaq’s Global Financial Crime Report, total check fraud losses in the Americas reached almost $21 billion, representing 80% of global check fraud losses, and Frank McKenna, chief strategist for Point Predictive, predicts that the financial impact will get closer to $24 billion by the end of 2024.

It’s worth remembering that this only reflects the financial impact of reported cases of check fraud. The FTC estimates that losses due to unreported fraud could extend to hundreds of billions of dollars.

FinCEN reporting shows that the average amount per reported check fraud was $44,774 in 2023, and the BBB calculates that the average fake check or money order scam costs financial institutions around $1,500 per item. Another study found that almost half of individual fraud victims lost more than $1,000 in each check fraud attack, and almost 25% lost more than $5,000.

Check fraud in different industries

Small businesses suffer disproportionately from check fraud, mainly because larger companies use Positive Pay to protect themselves against check fraud, and fraudsters know that small and medium businesses are a rich source of checks. Abrigo reports that 24% of small business owners experienced check fraud, compared with 15% of the general population, while the Mitek 2023 Mobile Deposit Benchmark Report found that nearly one-third of all small businesses in the U.S. were victims of check fraud in 2023. Of those, 65% reported losses exceeding $50,000.

Research by American Banker mirrored this trend. 52% of small business banking was affected by check fraud, compared with only 19% of large commercial and corporate banking.

Annual changes in check fraud incidents

When it comes to check fraud, most figures are pointing consistently upwards. A NICE Actimize study reported that check fraud deposit volume increased by 2.6% YOY, while fraud volume increased by 62%, revealing a 58% increase overall YOY.

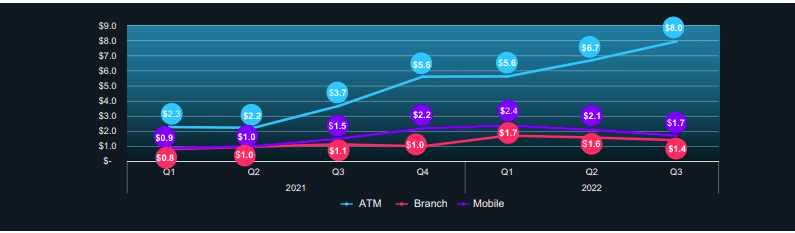

Breaking annual changes in check fraud down by channels, as shown in the chart below, the average loss per check for checks deposited at an ATM rose from $2.30 in 2021 to $8 in 2022. While all channels saw losses rise year on year, those at ATMs increased the most, rising 129% higher than for other channels.

Check fraud reporting mechanisms

When check fraud is discovered or suspected, it’s reported to the Federal Trade Commission (FTC), sometimes alongside local law enforcement authorities. Mail-related check fraud is also reported to the U.S. Postal Inspection Service, and cyber-related check fraud is reported to the Internet Crime Complaint Center (IC3) and the FBI.

The FTC usually compiles and disseminates check fraud statistics about reporting, releasing regular updates and analysis.

Law enforcement and check fraud statistics

Law enforcement has a mixed success rate in combating check fraud. An AFP study reports that 41% of check fraud victims managed to regain more than three-quarters of their lost funds, and 39% regained some amount but less than three-quarters. However, 30% weren’t able to recover any funds lost to check fraud.

The USPS is retrofitting collection boxes in 12,000 high-risk areas to make unauthorized access more difficult, but there are 139,409 USPS collection boxes in use around the country, so there are still many that are unprotected.

Impact of technology on check fraud statistics

According to research by American Banker, only 50% of respondents think that their bank is very or mostly effective at detecting fraudulent checks, with inadequate software cited as one of the top three causes. 55% agreed that their bank also struggles to process alerts about possible check fraud.

When asked if they would use a system that automatically alerts customers about suspect checks so they can review and validate them without requiring a phone call, 87% of all respondents said they would probably or definitely use it.

When Valley Bank, a top-50 US bank, implemented Refine Intelligence’s Direct User Outreach solution, the bank saw:

- A 70% reduction in RFI workloads by line of business

- Customer outreach time drop from 2 weeks to 2 minutes

- 85% completion rates for customer outreach

- 99% Neutral or Positive ratings from customers for digital outreach inquiries

Role of banks in collecting check fraud data

Most reports of check fraud are filed by banks, according to FinCEN data. 88% of filings are filed by banks, 44% of them by the largest banks by asset size. 31 banks filed over 100 reports between February and August 2023. Credit unions and securities or futures firms filed 11.5% of the total.

Public awareness and check fraud statistics

Research by Abrigo shows that public awareness around check fraud is far lower than it should be. Consumers fear credit card theft more than check fraud, but check fraud is a bigger liability for financial institutions. Only 35% of consumers know about check theft through the mail, and 73% don’t know that writing checks using gel pens can reduce check fraud.

Small business owners, however, have a greater awareness about check fraud, with Abrigo reporting that 50% are proactive about check fraud education, compared with only 13% of the general population.

Sources of check fraud statistics and data

If you’re looking to keep abreast of check fraud statistics, here are some reliable data sources:

- FinCEN reports come out once or twice a year, or more often if there’s a special investigation.

- The American Bankers Association (ABA) publishes news updates related to check fraud.

- The Association for Financial Professionals (AFP) publishes research into topics related to financial fraud, banking, and risk.

- Thomson-Reuters covers important developments in the area of financial fraud.

- Payments Dive covers reports and developments around fraud and risk.

- SP Global periodically runs research in banking and financial services topics.