Check Fraud Prevention

for Check Fraud Prevention

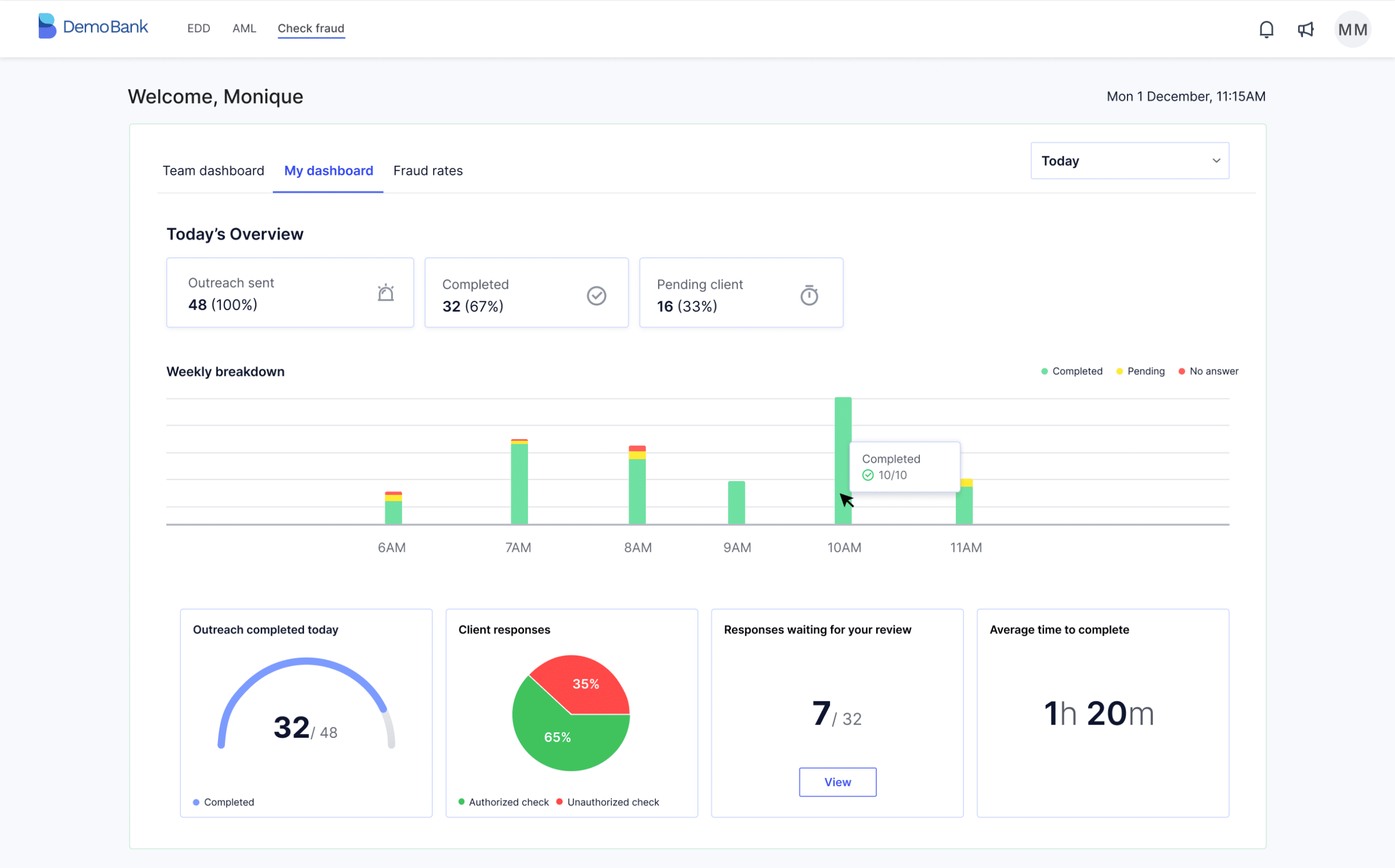

Check fraud is surging, with a growing level of sophisticated counterfeit techniques. Check Fraud detection systems typically produce a massive amount of daily alerts at a high false positive rate, and the fraud team needs to resolve them in a very short period of time with very little context.

The best way to resolve the alert and prevent check fraud is to ask customers about those checks – but chasing them over the phone is an expensive, unscalable burden on the line of business and the fraud operations team.

Refine offers a solution – automated, intelligent customer outreach for Check Fraud!

60 seconds to complete an RFI response

Extremely high customer response rates

Reduce fraud loss

Benefits

- Works with any check fraud detection system

- Scales up fraud prevention through high-velocity RFIs

- Get immediate ROI as you reduce check fraud costs

- Let your customers validate their checks within minutes

- Tailor the workflow and inquiries to your unique operational needs

- Seamlessly scale your fraud operations with an automated platform